Payment as a Service Market: A Comprehensive Overview

The Payment as a Service (PaaS) market is transforming the landscape of financial transactions, offering businesses innovative and flexible payment solutions. This article provides a detailed analysis of the PaaS market, including market overview, key market segments, the latest industry news, leading companies, market drivers, and regional insights. Payment as a Service Market is projected to grow from USD 14.01 Billion in 2024 to USD 63.53 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 20.80% during the forecast period (2024 - 2032).

Market Overview

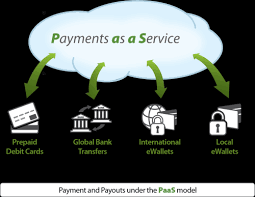

Payment as a Service (PaaS) refers to outsourced payment solutions that enable businesses to handle transactions, including processing, authorization, and settlement, without the need to build and maintain their own payment infrastructure. PaaS providers offer comprehensive payment platforms that support various payment methods, currencies, and compliance with regulatory standards.

The PaaS market is experiencing rapid growth due to the increasing demand for seamless and secure payment processing solutions. Businesses of all sizes, from startups to large enterprises, are adopting PaaS to enhance their payment capabilities, reduce operational costs, and improve customer experiences.

Request To Free Sample of This Strategic Report - https://www.marketresearchfuture.com/sample_request/8020

Key Market Segments

-

By Component:

- Platform: Core technology that enables payment processing, integration, and management.

- Services: Include consulting, implementation, and support services that help businesses leverage PaaS solutions effectively.

-

By Payment Method:

- Credit/Debit Cards: Traditional card-based payment processing.

- Digital Wallets: Payment solutions like PayPal, Apple Pay, and Google Wallet.

- Bank Transfers: Direct transfers between bank accounts, including ACH and wire transfers.

- Cryptocurrencies: Payments made using digital currencies like Bitcoin and Ethereum.

-

By End-User:

- Retail: E-commerce and brick-and-mortar stores adopting PaaS to streamline payment processes and enhance customer experiences.

- BFSI (Banking, Financial Services, and Insurance): Financial institutions using PaaS for secure and efficient payment handling.

- Healthcare: Hospitals and healthcare providers implementing PaaS for patient billing and payments.

- Hospitality: Hotels and travel agencies leveraging PaaS for seamless booking and payment experiences.

- Telecommunications: Telecom companies using PaaS to manage customer payments and subscriptions.

-

By Enterprise Size:

- Small and Medium Enterprises (SMEs): SMEs adopting PaaS for cost-effective payment solutions.

- Large Enterprises: Large corporations using PaaS for robust and scalable payment processing.

Industry Latest News

The PaaS market is dynamic, with continuous innovations and strategic developments. Some of the latest industry news includes:

- Mergers and Acquisitions: Major players are acquiring startups and smaller companies to expand their service offerings and market reach. For example, in 2021, Square acquired Afterpay to enhance its PaaS capabilities in the buy-now-pay-later segment.

- Product Launches: Companies are introducing new PaaS solutions with advanced features. Recently, Stripe launched Stripe Treasury, offering APIs for embedding financial services into any platform.

- Strategic Partnerships: Collaborations between fintech companies and traditional financial institutions are common. For instance, PayPal partnered with UnionPay to expand its reach in the Chinese market.

Payment Service Companies

Several key players are driving the growth of the PaaS market:

- Stripe: Known for its developer-friendly APIs, Stripe offers a comprehensive suite of payment solutions for businesses of all sizes.

- Adyen: Adyen provides a global payment platform that supports various payment methods and currencies, focusing on unified commerce solutions.

- PayPal: A leader in digital payments, PayPal offers PaaS solutions through its extensive network and services, including Braintree and Venmo.

- Square: Square provides PaaS solutions tailored to small and medium-sized businesses, including point-of-sale systems and online payment processing.

- Fiserv: Fiserv offers a range of PaaS solutions, focusing on secure and efficient payment processing for various industries.

Market Drivers

Several factors are driving the growth of the PaaS market:

- Increasing Adoption of Digital Payments: The shift towards digital payments, accelerated by the COVID-19 pandemic, is driving the demand for PaaS solutions. Consumers and businesses alike are moving away from cash transactions, favoring digital payment methods.

- Need for Seamless Customer Experience: Businesses are prioritizing seamless and secure payment experiences to enhance customer satisfaction and loyalty. PaaS solutions offer the necessary infrastructure to achieve this.

- Cost Efficiency: PaaS allows businesses to outsource payment processing, reducing the need for significant investment in payment infrastructure and maintenance.

- Regulatory Compliance: PaaS providers help businesses comply with regulatory standards and security protocols, reducing the risk of non-compliance and associated penalties.

- Technological Advancements: Innovations in payment technologies, including blockchain, AI, and machine learning, are enhancing the capabilities of PaaS solutions, making them more efficient and secure.

Ask for Customization - https://www.marketresearchfuture.com/ask_for_customize/8020

Regional Insights

The adoption of PaaS varies across different regions:

- North America: North America is a leading market for PaaS, driven by high adoption rates of digital payments, a robust fintech ecosystem, and significant investments in payment technologies. The United States is the largest market in this region, with numerous key players headquartered there.

- Europe: Europe is experiencing significant growth in the PaaS market, with countries like the UK, Germany, and France leading the adoption. The region’s strong regulatory framework and focus on digital innovation are key drivers.

- Asia-Pacific: The Asia-Pacific region is poised for rapid growth, with increasing digitalization, rising e-commerce activities, and government initiatives promoting digital payments. China, India, and Japan are key markets.

- Latin America and MEA: These regions are gradually adopting PaaS solutions, driven by the need for improved payment infrastructure and financial inclusion. Brazil and South Africa are notable markets showing promising growth.

Conclusion

The Payment as a Service market is on a robust growth trajectory, driven by the increasing adoption of digital payments, the need for seamless customer experiences, and the benefits of outsourcing payment processing. Continuous innovations and strategic developments are enhancing the capabilities and appeal of PaaS solutions. As businesses across various sectors continue to prioritize digital transformation and customer satisfaction, the demand for PaaS is expected to remain strong, shaping the future of the financial services industry. Organizations investing in PaaS technologies can benefit from increased operational efficiency, cost savings, and the ability to offer superior payment experiences to their customers.